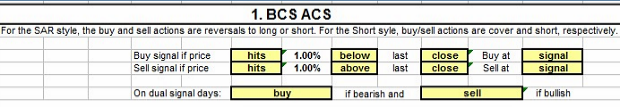

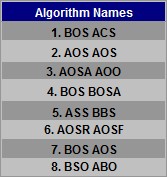

We use acronyms which fully encapsulate the way the algorithms work. In the Algorithm Name panel you will see the acronyms of the eight algorithms which will be compared whenever you run the simulations. Each acronym comprises two groups of letters; the left hand group is the buy side strategy and the right hand group is the sell side strategy. The easiest way to understand the acronyms is to go to the STRATEGY tab, change the algorithms and watch the acronyms change. In this example we start with BCS ACS.

Algorithm Science

Trading Strategy Discovery

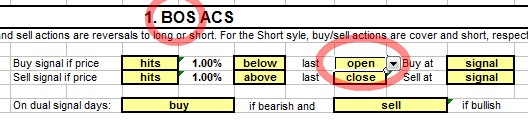

Notice how the acronym has changed from BCS ACS to BOS ACS.

There are scores of Buy side and Sell side strategies to choose from, here's your choices and how the acronym is constructed. Letters 1, 2 and 3 are always present, the Prefix and Suffix may be absent.

Prefix: Hit or Miss buy/sell point

You can choose to generate a signal if you either hit (no letter) or Miss a buy or sell point.

Letter 1: Above or Below reference price

You can choose whether the buy and sell points are Above or Below the reference price.

Letter 2: Reference price

The buy and sell points are fixed percentages above or below the reference price--

Open--the current day's open price

Close--the previous day's close

High--the previous day's high

Low--the previous day's low

Sell--the last sell price (buy side only)

Buy--the last buy price (sell side only)

Y.Open--the previous days open

MA--simple moving average

EMA--exponential moving average

Ave(HL)--previous day's (H+L)/2

User defined reference price

Moving average periods can be changed. The user defined reference price is initially set to (O+H+L)/3.

Letter 3--Trade execution time

You can choose to execute the sale when the Signal arrives (the buy or sell point price is reached), or at the following close or open.

Suffix--Behaviour on Dual Signal Days

Normally this is set up to buy if bearish and sell if bullish, in which case there is no suffix. However, you can simulate special behaviors on days when both a buy and sell signal occurred. For example you can choose to Ignore both signals, Buy AND Sell or Buy and Sell only when the price Rises or Falls for the day. Using these options is frequently hypothetical because unless trade execution time is set to Close or Open, we don't know which order the signals arrived in. PriceDelta will usually warn you if the algorithm you are setting up is hypothetical. Use these options with caution.

There are scores of Buy side and Sell side strategies to choose from, here's your choices and how the acronym is constructed. Letters 1, 2 and 3 are always present, the Prefix and Suffix may be absent.

Prefix: Hit or Miss buy/sell point

You can choose to generate a signal if you either hit (no letter) or Miss a buy or sell point.

Letter 1: Above or Below reference price

You can choose whether the buy and sell points are Above or Below the reference price.

Letter 2: Reference price

The buy and sell points are fixed percentages above or below the reference price--

Open--the current day's open price

Close--the previous day's close

High--the previous day's high

Low--the previous day's low

Sell--the last sell price (buy side only)

Buy--the last buy price (sell side only)

Y.Open--the previous days open

MA--simple moving average

EMA--exponential moving average

Ave(HL)--previous day's (H+L)/2

User defined reference price

Moving average periods can be changed. The user defined reference price is initially set to (O+H+L)/3.

Letter 3--Trade execution time

You can choose to execute the sale when the Signal arrives (the buy or sell point price is reached), or at the following close or open.

Suffix--Behaviour on Dual Signal Days

Normally this is set up to buy if bearish and sell if bullish, in which case there is no suffix. However, you can simulate special behaviors on days when both a buy and sell signal occurred. For example you can choose to Ignore both signals, Buy AND Sell or Buy and Sell only when the price Rises or Falls for the day. Using these options is frequently hypothetical because unless trade execution time is set to Close or Open, we don't know which order the signals arrived in. PriceDelta will usually warn you if the algorithm you are setting up is hypothetical. Use these options with caution.