Algorithm Science

Trading Strategy Discovery

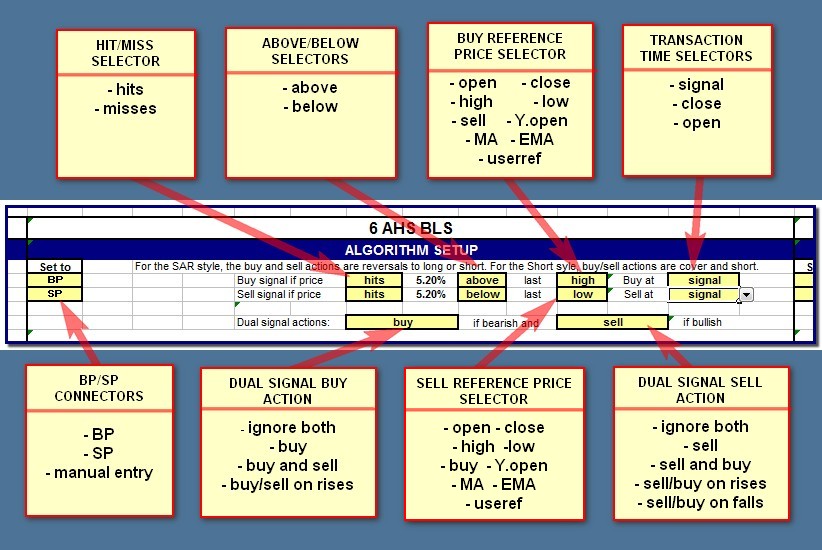

There's plenty of choice when it comes to setting up the algorithms you want to simulate and compare.

Hit/Miss Selector

Choose from hit or miss. If you pick hit, a signal is generated when the target price is hit. Choose miss and the signal is generated if the target price is not hit. For miss, the transaction time should be set to the close of the session or the following open as the signal can't arrive until the end of the session (you will get a warning if you try to buy or sell at signal).

Above/Below Selector

Select above or below. If you choose above, the target price will be above the reference price, otherwise it will be below.

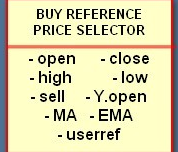

Buy/Sell reference price selector

Can be Open, Close, High, Low, Y.open, MA, EMA or Useref. For the buy side it can also be the last Sell price, and for the sell side, the last Buy price. Open means the current days open, whereas Y.open means the previous day's open. MA is a simple moving average, and EMA an exponential moving average. You can change the moving average periods. Useref refers to a column on the Strategy tab (currently column G) where you can type in a formula to set the reference price to a user defined value. By default it is set to (High+Low)/2.

Transaction time selection

You can pick whether the transactions occur when the Signal arrives, or at the subsequent Close or the following Open.

Dual Signal Buy/Sell Actions

A dual signal day occurs when both a buy and a sell signal come along on the same day. PriceDelta can simulate what happens in various dual signal scenarios. The default action is to buy if you started the session in the bearish state and sell if you started the session in the bullish state. See the "State at Open" column to read this off. You can change this behavior using these controls. First, you can choose to ignore both signals. In reality you can only do this if you have set the transaction time to close or open, but you can simulate the hypothetical effect if you were buying and selling at signal. Secondly you can choose to both sell and buy (always, on price rises or price falls). These are usually hypothetical scenarios because you don't know the order of arrival of the signals, but not always. For example in the algorithm AOS 1% AOS 2% the buy signal will always occur before the sell signal on dual signal days.

BP/SP Connectors

Normally these are set to BP and SP (buy-point and sell-point) for the buy and sell sides respectively. If you set them both to BP the buy point will appear in both the buy and sell side expressions. Similarly you can set them both to SP, or you can invert them. You can also manually enter a percentage value to fix the buy and/or sell side percentages during the scanning. These controls can be very useful when combining signals between algorithms. For example, suppose you are running Alg 1 signals into Alg2. You could set up both BP/SP connectors in Alg1 to be BP, and both in Alg2 to be SP. You can then scan for both algorithm optimums at the same time.

Hit/Miss Selector

Choose from hit or miss. If you pick hit, a signal is generated when the target price is hit. Choose miss and the signal is generated if the target price is not hit. For miss, the transaction time should be set to the close of the session or the following open as the signal can't arrive until the end of the session (you will get a warning if you try to buy or sell at signal).

Above/Below Selector

Select above or below. If you choose above, the target price will be above the reference price, otherwise it will be below.

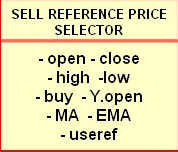

Buy/Sell reference price selector

Can be Open, Close, High, Low, Y.open, MA, EMA or Useref. For the buy side it can also be the last Sell price, and for the sell side, the last Buy price. Open means the current days open, whereas Y.open means the previous day's open. MA is a simple moving average, and EMA an exponential moving average. You can change the moving average periods. Useref refers to a column on the Strategy tab (currently column G) where you can type in a formula to set the reference price to a user defined value. By default it is set to (High+Low)/2.

Transaction time selection

You can pick whether the transactions occur when the Signal arrives, or at the subsequent Close or the following Open.

Dual Signal Buy/Sell Actions

A dual signal day occurs when both a buy and a sell signal come along on the same day. PriceDelta can simulate what happens in various dual signal scenarios. The default action is to buy if you started the session in the bearish state and sell if you started the session in the bullish state. See the "State at Open" column to read this off. You can change this behavior using these controls. First, you can choose to ignore both signals. In reality you can only do this if you have set the transaction time to close or open, but you can simulate the hypothetical effect if you were buying and selling at signal. Secondly you can choose to both sell and buy (always, on price rises or price falls). These are usually hypothetical scenarios because you don't know the order of arrival of the signals, but not always. For example in the algorithm AOS 1% AOS 2% the buy signal will always occur before the sell signal on dual signal days.

BP/SP Connectors

Normally these are set to BP and SP (buy-point and sell-point) for the buy and sell sides respectively. If you set them both to BP the buy point will appear in both the buy and sell side expressions. Similarly you can set them both to SP, or you can invert them. You can also manually enter a percentage value to fix the buy and/or sell side percentages during the scanning. These controls can be very useful when combining signals between algorithms. For example, suppose you are running Alg 1 signals into Alg2. You could set up both BP/SP connectors in Alg1 to be BP, and both in Alg2 to be SP. You can then scan for both algorithm optimums at the same time.